Actual Consumption of raw materials in SAP (Distribution of physical inventory difference over FG productions)

The actual consumption of raw materials in production planning module in SAP always gets the consumption quantity from BOM of the SFG/FG. However the actual consumption quantity or RM would always be different than the standard consumption as per the BOM.

Here we face the issue of reporting the correct consumption of raw materials for SFG/FG production and in the financial as well we are not in a position to report the true consumptions.

The differential quantity i.e. actual consumption of raw material and the standard consumption of raw materials will be worked out or surfaced only when we do the physical verification of our Raw materials on a monthly basis. That time the actual inventory of RM and the SAP Books inventory of RM would not tally just because of this same reason of Actual consumption vs. Standard BOM Consumptions.

Since this is a practical scenario and none of the large manufacturing industry can feed the actual consumption of material by measuring the actuals at the time of production confirmation in SAP. So we need to find a solution as how to adjust our standard consumption with the actuals after the physical verification of inventory for Raw materials.

Hence the objective is to allocate the difference of physical verification as recorded to all the production orders / process orders/product cost collectors on the basis of respective raw material consumption quantity, this should also correct the postings in Finance and MM books as well. After that the production order/ process order / PCC should reflect the actual consumption of RM and not the standard consumption of RM.

For input consumption quantity the movement type will be 261 for issue and 262 for reversal of the goods issue, in case of the adjustment of the input consumption quantity thru the DOUV SAP system will use the movement type Z61 for increase in the issue quantity and Z62 for the decrease in the issue quantity.

Step no.1: Creation of physical inventory document; (MI01)

In this transaction the physical inventory document need to be created against the plant, material code, storage location, valuation type. & batch.

Step no.2: Counting of the inventory against the physical inventory document (MI04)

In this step the actual count of the said material code against the storage location, valuation type and batch need to be confirmed and entered in the system, and saving the physical inventory document.

Step no.3: Posting of the difference inventory against the physical inventory document (MI07/MI20)

In this step the difference between the book (SAP) quantity and actual (Counted) quantity will be getting posted and the actual stock will now reconciled with the book stock. In consequence to the same the accounting entry also getting generated; The accounting entry for the same will be as under:

Stock account Dr./Cr.

To Change in stock / Consumption Account Dr./Cr. (OBYC- GBB-INV)

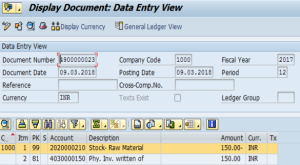

Accounting entry after Physical Inventory verification in SAP.

Step no.4: Running of the DOUV transaction against the physical inventory document: (T.Code CKMDUVMAT)

In this step the difference which is getting posted in the step no.3 above will now be distributed over the process orders of the desired interval. However the posting date field is also there where we can enter the posting date (not before the previous period and after the current period)

Stock account Dr./Cr.

To Change in stock / Consumption Account Dr./Cr.

Stock account Dr./Cr.

To Change in stock / Consumption Account Dr./Cr.

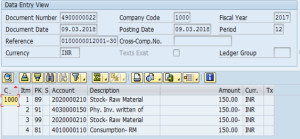

After the distribution of physical difference to Production orders the accounting entry will be as under:

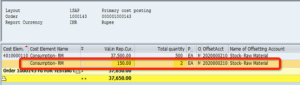

Here you can see distributed quantity in production order.

Conclusion:

It ensures the raw material consumptions in our books of accounts get reflected correctly.

Fell free get in touch with us via phone or send us a message