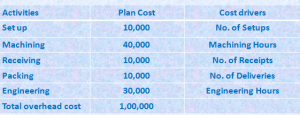

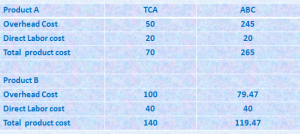

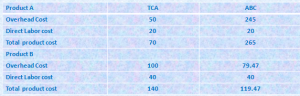

Step 1,2,3 are Identification of activities, determine cost for each activity, determine cost drivers, respectively

Step 1,2,3 are Identification of activities, determine cost for each activity, determine cost drivers,

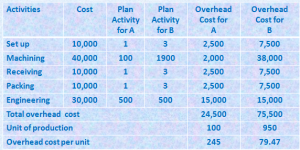

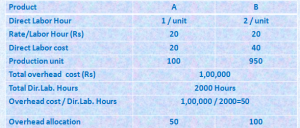

Allocation of indirect expenses/overheads to products is based on volume based measures e.g. labor hours , machine hours , (assumption is relation between overhead and volume based measures)

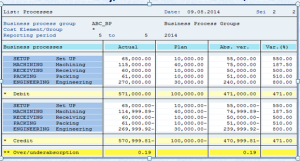

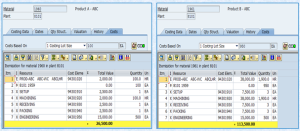

Step 4 & 5 are collect activity data and calculate product cost

Allocation of indirect expenses/overheads to products is based on volume based measures e.g. labor hours , machine hours , (assumption is relation between overhead and volume based measures)

Allocation of indirect expenses/overheads to products is based on volume based measures e.g. labor hours ,

Fell free get in touch with us via phone or send us a message